You’re a realtor at an open house. One family looked around a bit, expressed that they are very interested, took your card, and then walked out soon after arriving. Another couple quietly traipsed through each room, cooing over the crown molding, whispering about where the new baby’s room would be, laughing in the kitchen. With whom do you follow up?The ones who acted interested!

You’re a realtor at an open house. One family looked around a bit, expressed that they are very interested, took your card, and then walked out soon after arriving. Another couple quietly traipsed through each room, cooing over the crown molding, whispering about where the new baby’s room would be, laughing in the kitchen. With whom do you follow up?The ones who acted interested!

If you want to sell credit repair to people who value it most, you need to pay attention to the cues people give you that they want to improve their scores. Here are three ways to focus on the right clients: Ready, Aim, and Fire!

Find People Who are READY

While anyone can benefit from credit repair, there is a specific kind of person you should focus on selling credit repair to:

- Current FICO score is very low (850 is a perfect score)

- Looking to purchase a home, buy a car, or get a loan of any sort (like a small business loan) in the near future

Families trying to purchase a home, get a new car, or start a business venture will value credit repair services most because they all need great credit scores to reach their immediate financial goals. As a credit repair business owner, your goal is to sell credit repair services to people who understand the value of what you do because they will be committed to seeing the credit repair process through.

I’m going to level with you here: not every person who has a bad credit score is ready and willing to do the work to improve it.

Starting a credit repair business is simple, but you only have so many hours in a day to send dispute letters and follow up with your clients. Focus your time and energy to sell credit repair services to families and community members who are ready for it.

No one knows what is going on behind a family’s closed financial doors, which is why referrals from your friends and family members are so valuable.

When you sell credit repair to your friends and family by giving a free credit consultation up front, they will see the value of what you do and be excited to share it with the people in their lives. Almost everyone knows someone who is getting ready to make a significant purchase, and they can typically use a little help getting their score up.

Here’s the secret that many who sell credit repair don’t understand:

Credit repair is also excellent for people with a good credit score.

AIM at Specific Goals

Business owners should also sell credit repair to people with a good credit score because the difference of 50 to 100 points can mean thousands of dollars saved over the lifetime of a loan.

As a credit repair business specialist, your goal is not to sell credit repair. Your role is to:

- Educate your community on the value of credit repair (in tangible dollar amounts)

- Find people who are excited about the possibility of doing a little work to make a monumental difference in their financial future

- Help people create better financial habits while you do the busywork of responding to bureaus and keeping track of all the details

Selling credit repair to clients comes down to showing value.

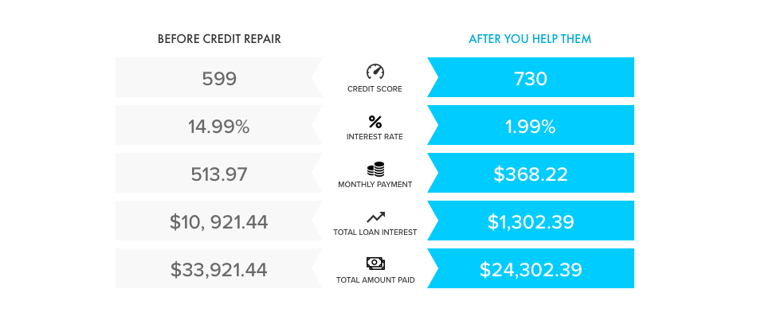

Let’s look at a family that wants to purchase a new Toyota Camry at $23,000.

Without credit repair services this family would have paid $9,616.05 more for the same car!

Before credit repair, this family may look at the interest rate alone and walk off the lot. If you can sell credit repair to them to increase their credit score, they will pay almost $10,000 less over the life the loan! Once you show value to a prospect, don’t be shy about asking for a commitment to work together to reach that goal.

Clients may ask you what you can do for them that they cannot do for themselves, and the short answer is nothing. However, your experience and expertise make sure it is done the right way, quickly.

Stay on FIRE

Once you get a happy client a better rate on their loan or reduce their total monthly payments by thousands, you’d better believe they want to share you with everyone they know! Following up with happy clients will grow your business and generate credit repair business leads.

As you expand your business and sell credit repair more confidently, reach out to local financial affiliates and explain to them what you do to help their leads turn into clients. Working with auto dealers, mortgage brokers, divorce attorneys, and other financial affiliates is a proven way to skyrocket your business. Read this story from one of our credit repair software users that brings in millions annually with referrals from financial affiliates.

To sell credit repair to those who value it most, all you need to remember is Ready, Aim, Fire.

- Find people who are ready for your help

- Aim at measurable and specific financial goals

- Stay on fire about helping more people.

CTA: To learn how to start, run, or grow a credit repair business, watch this webinar from the experts!